ASIC鈥檚 governance and accountability structures are consistent with 魅影直播 being an independent Commonwealth agency that is a statutory body corporate. They reflect the legislative framework within which 魅影直播 operates.

ASIC鈥檚 governance and accountability framework

ASIC鈥檚 governance and accountability framework (the Framework) sets out a clear, transparent and common understanding of 魅影直播鈥檚 governance and accountability structures and processes. The objective of the Framework is to promote effective, efficient and impartial decision making at 魅影直播 and articulate clear accountabilities. The Framework seeks to ensure 魅影直播 acts strategically, with integrity and effectively delivers on its statutory objectives.

The Framework sets out how the Commission will collectively exercise its functions and powers, as well as delegate to others. It helps 魅影直播 to achieve its strategic priorities, manage risks and use resources responsibly.

ASIC is a body corporate established under the 魅影直播 Act 2001 (Cth) (魅影直播 Act). 魅影直播 is made up of Commissioners who are appointed by the Governor General on nomination of the Minister.

Under the 魅影直播 Act, Parliament has conferred functions and powers on the Commission and Chair of 魅影直播. 魅影直播鈥檚 functions and powers are also drawn from the laws we administer.

ASIC鈥檚 governance and accountability structures are consistent with 魅影直播 being an independent Commonwealth agency that is a statutory body corporate and reflects the legislative framework within which 魅影直播 operates. The Framework separately identifies decision-making in relation to governance matters and regulatory functions. It supports the Commission to exercise its functions and powers and oversee delegated matters.

The current Framework was introduced in December 2019 as part of 魅影直播鈥檚 strategic change program and to reflect 魅影直播鈥檚 revised leadership structure. It is regularly reviewed and updated.

A key purpose of the Framework is to enable the Commission to spend more time focusing on and setting 魅影直播鈥檚 strategy.

Commission and Accountable Authority

The Commission is 魅影直播鈥檚 governing body and is responsible for achieving 魅影直播鈥檚 statutory objectives set out in the 魅影直播 Act. It acts as a strategic non-executive body focusing on high-level regulatory and statutory decision-making and stakeholder management and provides support to the Chair on organisational oversight.

It makes important regulatory decisions, sets 魅影直播鈥檚 strategy and oversees 魅影直播鈥檚 delivery and performance against the strategy. In addition, the Chair is ultimately responsible for the duties of the Accountable Authority contained in the Public Governance Performance and Accountability Act 2013听(PGPA Act) which forms part of the executive responsibilities of governing 魅影直播.

The following table outlines the dual regulatory and governance roles of the Commission:

| Regulatory role |

Governance role (shared between the Accountable Authority and Commission) |

| Making strategic and/or significant regulatory decisions related to 魅影直播鈥檚 statutory powers and functions. |

Providing strategic leadership by setting 魅影直播鈥檚 vision, risk appetite and corporate plan, determining budget and resourcing priorities, 魅影直播鈥檚 Values and Code of Conduct and overseeing management performance and accountability and audit processes |

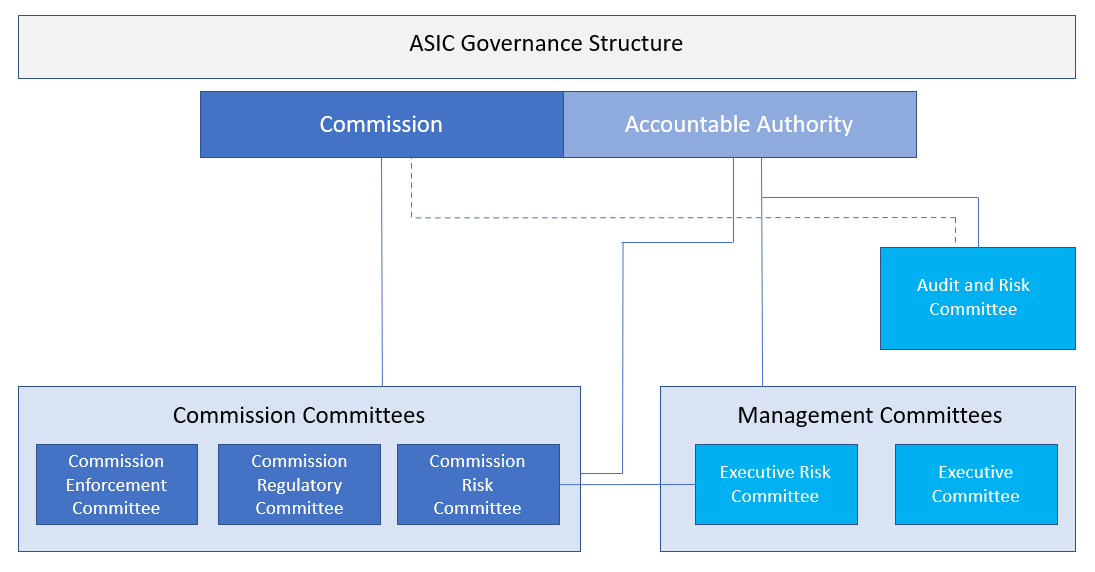

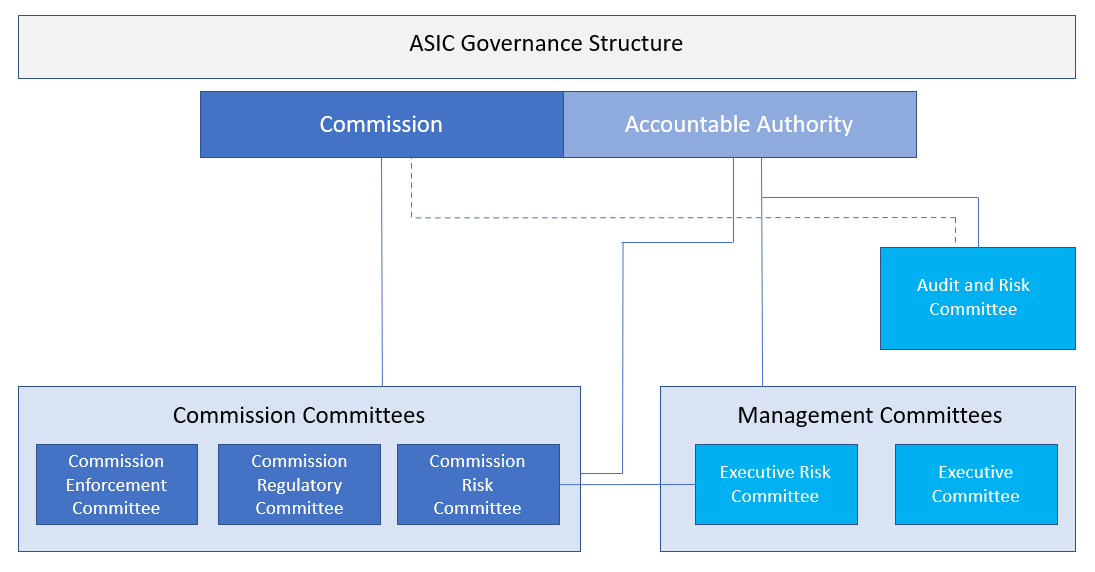

ASIC鈥檚 governance structure

ASIC鈥檚 governance structure supports the Commission in exercising its functions and powers by providing oversight of delegated matters and a structure for executives to elevate matters to the appropriate forum.

The Commission has established a number of committees to assist it with the effective and efficient performance of its dual regulatory and governance roles. The Commission undertakes these roles through Commission meetings, Commission Committees, Specialist Committees, Governance Committees and Management Committees.

ASIC may establish other sub-committees and boards from time to time.

Click to enlarge

More information

Commission meetings

Commission meetings are convened by 魅影直播鈥檚 Chair under Section 103 of the 魅影直播 Act. They generally take place weekly or as required.

The Commission is responsible for the exercise of 魅影直播鈥檚 functions and powers. It undertakes the following actions through Commission meetings:

- makes decisions on matters within 魅影直播鈥檚 regulatory functions and powers that are strategic and/or significant

- sets priorities for allocation of budget, and monitors performance against allocated budget

- approves team business plans

- supports the Accountable Authority in overseeing the management and operations of 魅影直播 as a Commonwealth agency

- reviews 魅影直播鈥檚 annual report, external performance assessment and organisational performance measures

- approves internal policies that set rules, guidelines and governing principles for:

- regulatory decisions that are delegated to management

- managing internal risk and compliance

- setting 魅影直播鈥檚 culture

- establishes the framework within which external representation and communication occurs, and determines messaging and presentation for strategic matters

- approves delegations from the Commission.

Commission Committees

Commission Committees are decision-making committees and comprise the full Commission and other standing attendees. There are three Commission Committees:

While matters and decisions reserved for the Commission may be dealt with in formal Commission meetings, the Commission generally makes decisions in relation to strategic and/or significant enforcement, regulatory and risk matters within the relevant Commission Committee (except for formal statutory decisions which are only made in a formal Commission meeting). The Commission has established the Commission Committees so that it can dedicate time to, and provide specific focus on, these important areas of 魅影直播鈥檚 statutory mandate.

Commission Enforcement Committee

The Commission Enforcement Committee makes strategic and/or significant enforcement decisions (including in relation to conduct, strategy and focus of major matters and enforcement policies) and oversees 魅影直播鈥檚 enforcement and litigation work.

Commission Regulatory Committee

The Commission Regulatory Committee makes strategic and/or significant decisions relating to regulatory policy, law reform, applications for relief, policy frameworks and reports and oversees 魅影直播鈥檚 regulatory activities and functions.

Commission Risk Committee

The Commission Risk Committee considers all types of risk of a strategic and/or significant nature that affect 魅影直播, its regulated population, Australia鈥檚 financial system and Australian consumers. It is responsible for setting and monitoring ASIC's risk management framework and risk appetite. The Committee monitors 魅影直播 risk by reviewing and challenging whether material risks have been identified, ensuring risk remediation plans are in place and challenging whether adequate resources have been deployed to appropriately manage risks.

Governance Committees

Governance Committees assist the Commission and the Accountable Authority in undertaking their governance roles. There are two Governance Committees:

Audit and Risk Committee

The Audit and Risk Committee operates independently of management and plays a key role in assisting the Chair to discharge their responsibilities for the efficient, effective, economical and ethical use of Commonwealth resources. This committee also provides independent advice to the Chair and the Commission on 魅影直播鈥檚 financial and performance reporting, risk oversight and management, and systems of internal control.

Management Committees

The Management Committees are executive level committees that are responsible for undertaking and overseeing the day-to-day management of 魅影直播. There are two Management Committees:

Executive Committee

The Executive Committee is responsible for assisting the Accountable Authority, Commission and Chief Executive Officer to manage 魅影直播, its budget and deliver 魅影直播鈥檚 business plans in alignment with 魅影直播鈥檚 strategic priorities and regulatory objectives and to manage the internal operations of 魅影直播 to deliver outcomes aligned with 魅影直播鈥檚 strategic direction and priorities.

Executive Risk Committee

The Executive Risk Committee is responsible for identifying and monitoring significant risks to 魅影直播, maintaining 魅影直播鈥檚 risk management frameworks and policies, managing risks in line with those frameworks and policies, and implementing and overseeing audit/assurance processes and risk mitigation strategies. It reports to the Accountable Authority and the Commission Risk Committee.

Executive Directors

Executive Directors play a key role within 魅影直播鈥檚 committee structure. They are standing attendees of various Commission Committees and members of the various Management Committees at which recommendations are made to the Commission or the AA. More information about the responsibilities of Executive Directors is outlined in ASIC鈥檚 Management Accountability Regime (AMAR).

ASIC's accountability

ASIC is subject to a robust framework of public accountability and transparency. 魅影直播 is accountable to the Parliament and many of its decisions are subject to administrative or judicial review. Ultimately 魅影直播 is accountable to the Australian public for its actions through publications of its Annual Report and other public documents and releases.

ASIC鈥檚 Management Accountability Regime (AMAR) clearly identifies the accountabilities of 魅影直播鈥檚 Chair, Commission members and Executive Directors.

As an independent statutory agency, 魅影直播 is not subject to a legislative accountability regime but has taken the opportunity to apply key features of the Banking Executive Accountability Regime (set out in Part IIAA of the Banking Act 1959) to its senior staff.

Accountability and oversight of 魅影直播

ASIC鈥檚 performance, and the exercise of its powers and functions, are subject to a range of public accountability measures.听

ASIC is established under the ASIC Act 2001 (Cth) (魅影直播 Act). It is made up of its Commissioners who are appointed by the Governor General on nomination of the Minister. Under the 魅影直播 Act, Parliament has conferred functions and powers on the Commission and Chair of 魅影直播.

ASIC is accountable to the Australian Parliament through the:

- Parliamentary Joint Committee on Corporations and Financial Services

- Senate Standing Committee on Economics

- House of Representatives Economics Committee.

The Parliamentary Joint Committee on Corporations and Financial Services is established under the 魅影直播 Act.听Its duties include inquiring into and reporting to the House of Representatives and the Senate on 魅影直播鈥檚 activities, the operation of the corporations legislation and any question connected with the Committee鈥檚 duties referred to it by either House.

The Government periodically issues statements of expectations and 魅影直播 responds through a statement of intent听setting out how it will respond to the Government鈥檚 expectations.

ASIC and the Accountable Authority are subject to a range of accountability measures for financial, regulatory and performance activity. 魅影直播 or the Accountable Authority are required to prepare the following:

- ASIC鈥檚 Corporate Plan covering its purpose, environment, performance, capability, and risk oversight and management

- Annual Portfolio Budget Statements that inform the Senate and Parliament of 魅影直播鈥檚 proposed resource allocation

- ASIC's Annual Reports, which are tabled in Parliament

- periodic audits conducted by the Australian National Audit Office

- self-assessments of performance against the six outcomes-based performance indicators in the Government鈥檚 (published October 2014).

In addition to oversight by Parliament and the relevant Minister, 魅影直播鈥檚 decisions can be subject to review by the:

- Courts

- Administrative Review Tribunal

- Commonwealth Ombudsman

- Office of Australian Information Commissioner

- Privacy Commissioner.

ASIC is also subject to oversight by the National Anti-Corruption Commission (NACC) and the Financial Regulator Assessment Authority (FRAA).

Read more about 魅影直播鈥檚 accountability and reporting.

Statutory responsibilities of the Chair and the Accountable Authority

While most powers vest in the Commission, some statutory powers only vest in the Chair.

Examples of powers and duties of the Chair include:

- engaging staff, and certain obligations under the Public Interest Disclosure Act 2013 (PID Act)

- determining the ASIC Code of Conduct and the ASIC Values under the 魅影直播 Act

- establishing and maintaining an appropriate system of risk oversight and management and an appropriate system of internal control.

In addition, the PGPA Act and Public Governance, Performance and Accountability Rule 2014 (PGPA Rule) impose several executive responsibilities on the Chair as the Accountability Authority of 魅影直播. The PGPA Act requires the Accountable Authority to govern 魅影直播 in a way that promotes:

- the proper use and management of public resources

- the achievement of the purposes of 魅影直播

- the financial sustainability of 魅影直播.听

The PGPA Act confers responsibilities on the Accountable Authority for matters including:

- the establishment and maintenance of an appropriate system of risk oversight and management and an appropriate system of internal control

- the financial management of 魅影直播

- compliance with reporting requirements.

Statutory responsibilities of Commissioners

Commissioners have personal statutory obligations under the PGPA Act. Section听25 of the PGPA Act requires each Commissioner to perform their functions and exercise their duties with the degree of care and diligence that a reasonable person would in the same circumstances.

They are accountable to the Minister regarding disclosure of personal interests under the 魅影直播 Act. Commissioners also have obligations under the ASIC Code of Conduct.

ASIC鈥檚 Values and behaviours

ASIC鈥檚 Values and Code of Conduct (the Code) guide and inform the expected behaviour of 魅影直播 employees. 魅影直播鈥檚 Values of Accountability, Professionalism and Teamwork underpin the way that all 魅影直播 employees are expected to work, make decisions and interact with others. Adherence to 魅影直播鈥檚 Values, compliance with the Code and the expectations set out in 魅影直播鈥檚 Management Accountability Regime (AMAR) individual accountability statements are assessed before performance bonuses are determined.

ASIC鈥檚 Management Accountability Regime

ASIC鈥檚 Management Accountability Regime (AMAR) applies to the accountable persons of 魅影直播. Under the AMAR, an accountable person is an individual who has senior executive responsibility for management or control of 魅影直播, or a significant part of the operations of 魅影直播.

The accountability statements for each accountable person provides:

- a transparent and common听understanding within 魅影直播 of where accountability lies for any particular听aspect of 魅影直播鈥檚 operations and who each accountable person is accountable听to

- a clear, transparent and common听understanding within 魅影直播 of how a given individual meets their听obligations as the accountable person, including for example by making听decisions, serving as a point of review or challenge, or escalating as听appropriate

- for those accountable persons consequences of failure to meet their obligations, whether by inappropriate action or failure to act, within their area of accountability.

ASIC鈥檚 accountable persons are:

- the Chair (acting as the Chair and the Accountable Authority, as well as a member of the Commission) and each Commissioner [AMAR statements currently under review]

- each Executive Director and other key staff [AMAR statements currently under review].

The AMAR will evolve as 魅影直播 reviews and changes its processes and procedures.

Accountable persons are required under AMAR to take reasonable steps to discharge their accountability obligations and attest annually that they have done so.